How to become a registered tax agent

Are you contemplating a career as a tax agent or simply curious about the what the role’s responsibilities and opportunities are?

While an accountant maintains the financial records of a business, a tax agent provides tax advice and prepares tax returns for the business.

What is a tax agent?

A tax agent is a professional who is fully licensed and registered. Their job is to assist people with their tax returns and other tax related services. To become a tax agent, you have to apply to the TPB (Tax Practitioners board) and pay a fee to register. Once approved, your registration will last for a minimum of three years.

Tax agents provide clients with information, work with clients as an adviser and can also represent clients to the ATO regarding tax disputes.

What are some examples of tasks tax agents can do?

Tax agents undertake numerous tasks in their role. Here are a few examples:

- Preparing and lodging tax returns

- Assisting with tax concessions

- Preparing depreciation schedules

- Giving advice on taxation law

- Represent a client to the Commissioner or ATO

Accountant vs tax agent

Accountants and tax agents are both registered professionals, but there are certain tasks that tax agents are allowed to perform that regular accountants are not.

Tax agents are able to provide certainty and advise clients. They can also represent their clients to the ATO but only in relation to taxation law.

Accountants have a wider net of general responsibilities and expertise, where as a tax agent is specifically focused on taxation law. They are also both regulated roles, however they are regulated by different bodies. Accountants are regulated by either CAANZ, CPA, or IPA, depending on their industry, qualifications, and preference, whereas tax agents are only regulated by the TPB.

Qualifications and experience for tax agents

If you want to provide tax agent services for a fee or other reward, you must be registered with the Tax Practitioners Board.

The Tax Agent Services Regulations 2022 (TASR) contains the rules about the qualifications and experience you need to become a registered tax agent[i].

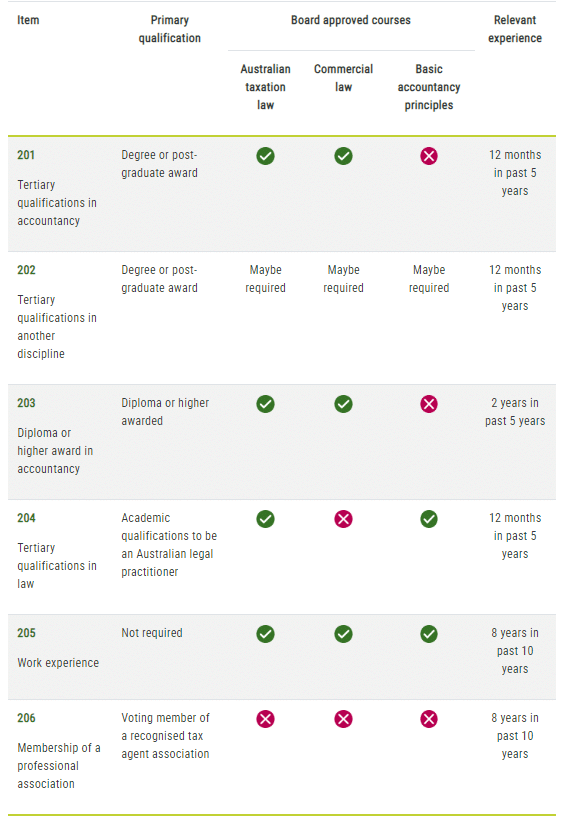

In 2024, you need a combination of a primary qualification + board approved courses + relevant experience.

Monarch’s FNS50222 Diploma of Accounting plus Tax Agent Certification course (TAC) meets both the qualification and board approved course requirements.

The type and number of board approved courses you need depends on your main qualification. So does the amount (and timing) of your work experience.

Here’s a summary:

Source: tpb.gov.au. Accessed Dec 2024.

What are board approved courses?

Board approved courses are nationally recognised units that have been approved by the Board for registration purposes.

Monarch Institute’s Tax Agent Certification Course is designed for those who have completed (or are completing) an accountancy qualification at a diploma or higher level, but have not completed the necessary Board approved courses to become a registered tax agent.

Australian taxation law

- Prepare tax documentation for individuals (MTL001) (FNSACC522)

- Prepare and administer tax documentation for legal entities (MTL002) (FNSACC601)

Commercial law

- Apply legal principles in contract and consumer law (MCL001) (FNSTPB503)

- Apply legal principles in corporations and trust law (MCL002) (FNSTPB504)

- Apply legal principles in property law (MCL003) (FNSTPB505)

The Australian taxation law units are also included in Monarch Institute’s Diploma of Accounting. If you need to complete the commercial law units, we recommend you add the Tax Agent Certification course to your Diploma of Accounting.

What is ‘relevant experience’?

Relevant experience’ generally means hands-on work experience in a business that provides tax agent services. Tax agent services are defined in the Tax Agent Services Regulations 2022 (TASR). They include things like advising on a client’s potential tax liabilities based on their personal info, or working out the client’s obligations to enter in to accounting software. They do not include things like data entry and admin work.

Your work experience needs to be verified by your supervisor/s using a Statement of relevant experience (SRE) form, available on the TPB website.

What are the other requirements for registration?

Once you’ve got the right qualifications and experience, you can apply to become a registered tax agent as long as you:

- Are at least 18 years old.

- Are a ‘fit and proper person’. This means:

- You have a good reputation in the community.

- You haven’t been convicted of serious offences including tax offences, or other offences involving some sort of fraud or dishonesty.

- You’ve never been in prison.

- You aren’t an undischarged bankrupt.

- Get (and maintain) professional indemnity insurance.

- Minimum level of insurance depends on turnover of tax agent services business, but can be between $250,000 and $1 million worth. Depending on your circumstances, premiums may start at about $40 a month.

Getting registered as a Tax Agent

You can apply online for registration.

The application fee is $738 for individuals to register.

Before you start, you’ll need to make sure you have:

- Electronic copies of your qualifications, transcripts, and course outlines for the studies you’ve done.

- Your Statement/s of relevant experience from employer/s. NB: If you’re no longer with an employer, they’re still generally obliged to fill in your SRE form.

- Details of your tax agent association membership (if held).

Applications are generally processed within 30 days.

The information provided here is a guide only. It was current at the time of publication (October 2022) by Monarch Institute, but may be subject to changes by the TPB. Please check with the TPB to ensure you have the latest information, and for any special requirements for your individual circumstances.

If you’re keen to chat more about studying a qualification online to enhance your accounting and bookkeeping career, get in touch today or enrol now.